47

Creative

Clusters

Golden Research Triangle

The already very well established

Golden Research Triangle between

Oxford, Cambridge and London

is becoming ever more important.

Driven by world class research

universities, it has become a globally

significant biomedical, medical and

technology cluster with a cutting-

edge focus on pharmaceuticals, life-

sciences and bio-technology.

Almost half of the UK’s 183,000 life

science jobs are concentrated in the

region, and the cluster itself provides

highly skilled employment for 36,000

people. It invests more in R&D than

any other sector in the UK and

accounts for around 30% of the UK’s

total R&D spend. The area boasts five

of the world’s top medical research

universities.

As well as its strong science base,

the South East offers life sciences

companies an ideal place to conduct

medical trials, mainly because of the

genetic diversity of London’s 8 million

population.

The Golden Research Triangle

makes a good case to be the strongest

bioscience cluster in Europe and the

fourth in the world. A study conducted

last year by Ernst & Young for the BIA

(The BioIndustry Association) put the

UK ahead of Germany and Switzerland

(measured by the number of biotech

products being developed).

Although dwarfed by the USA, the

UK has the largest source of private

sector funding in Europe. However, as

the EU is the largest source of public

sector funding, Brexit poses a risk to

the sector and the cluster.

A major support component for the

Golden Research Triangle, and in fact

for the UK’s significant opportunity in

medical diagnostics, is the medical big

data capability provided by clusters

such as the one in Harwell.

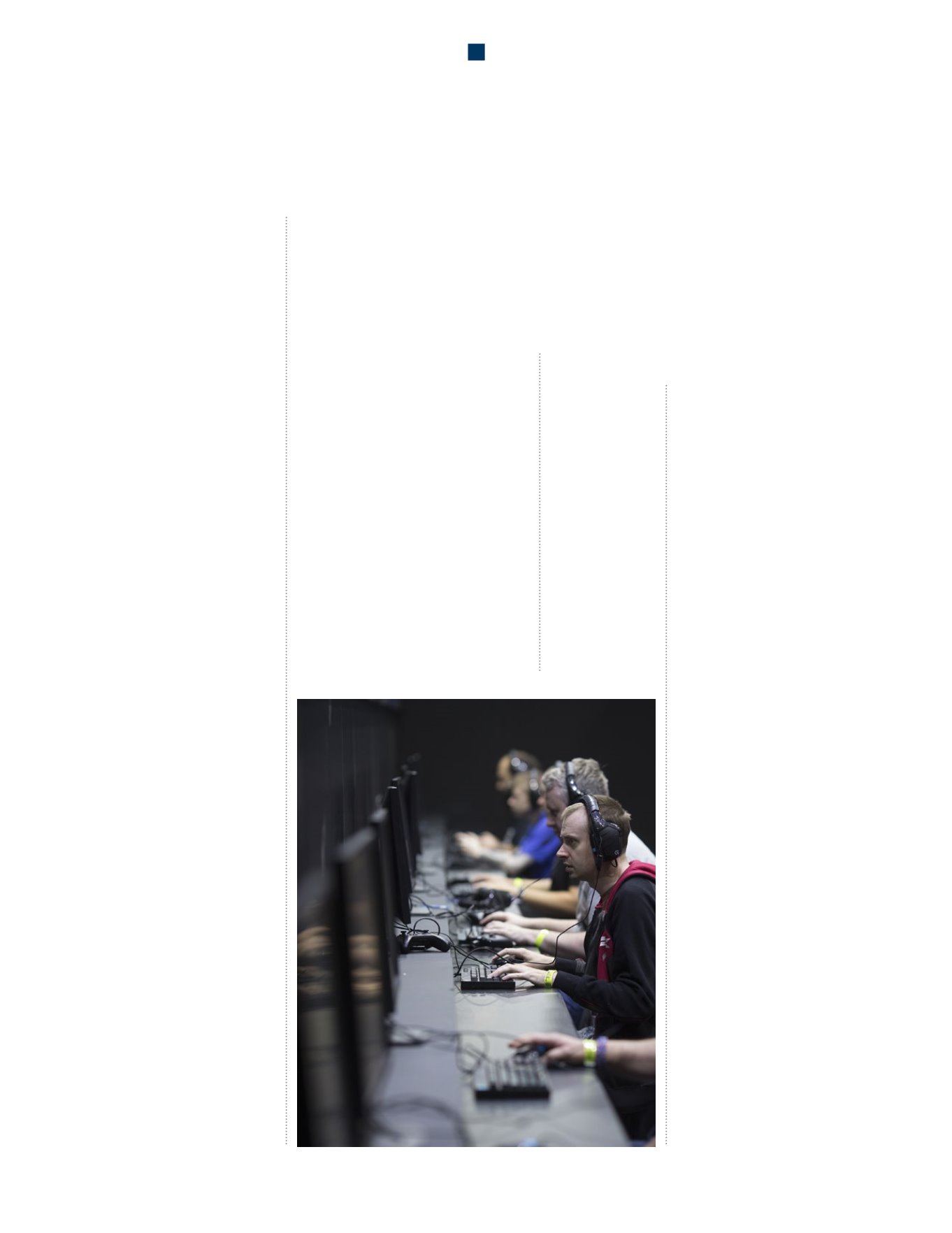

The creative industries are becoming

more important in local economies.

Forty-seven creative clusters have

been identified across the UK. Rapid

growth has been experienced in all

sub-sectors including advertising,

film, radio and TV, architecture,

publishing, music and performing

arts. Service activities such as design,

software and digital have been doing

particularly well.

London and the South East are

major components of the UK creative

industries and together comprise

around a third of all clusters in the

sector. Other ‘hip creative cities’ include

Brighton, Cardiff, Nottingham, Leicester,

Manchester, Edinburgh and Glasgow.

In addition to London, which has

2,577 tracked entities and is the

largest and best known digital

tech cluster, there are another 31

recognised clusters across the UK.

In Scotland, Dundee, home of the

Beano and Dandy, has long boasted a

thriving games sector on the back of

its media creativity and is also home

to the University of Abertay which

provides courses in related subjects.

Similarly, Edinburgh is the location

for two billion-dollar companies in

Skyscanner and gaming start-up

Fanduel.

In the north of England, Leeds

and Sheffield are developing their

digital base and have an economy

of £3.4bn per year between them.

Sheffield is marketed as the ‘maker

city’, while Leeds is the ‘data city’ and

has a strong focus on FinTech. Across

the Pennines, Manchester is setting

itself up as the engine of the Northern

Power House and is aiming to build

on its media and financial clusters

to become one of the top 20 digital

cities in the world by 2020.

Further south, Cambridge has

long been one of the UK’s most

dynamic technology centres. It has

connections with the university and

local expertise in deep tech such as

artificial intelligence and internet

security. Global success stories

include ARM, Cambridge Silicon

Radio and Autonomy, all of which

have been swallowed by large

global tech conglomerates.

In telecoms, there are notable

clusters at Harwell in Oxfordshire

and in Ipswich on the back of BT’s

Adastral Park.

Reading has traditionally

dominated along the M4 corridor

and 21.7% of its companies focus on

tech. However, other centres such

as Slough, Maidenhead, Newbury,

Swindon, Bristol, Bath and Cardiff

all have strong local clusters.

Belfast’s thriving tech centre

has been a surprising success story

in recent years and the city is now

home to a host of digital start-ups

in ecommerce and SAAS. Northern

Ireland not only has low overheads in

terms of rent and staffing but it also

has a large talent pool across many

disciplines.

Digital Tech Clusters

Biotech Clusters

Creative Businesses

Clusters

PERSPECTIVES

06

LEAD STORY