Government support

Not only is there Local Government enthusiasm for

attracting PRS into regeneration projects, but Central

Government has also responded to the opportunity for

increasing the flow of new build housing across the UK.

To show its support, which has perhaps been lacking

in previous years, Government has established a Housing

Infrastructure Fund to provide £2.3bn for build-to-rent

projects. While, as usual, there are significant hoops to

jump through to obtain this funding, it is a game changer

for developers and investors alike and shows a tangible

commitment by the Government to expand the UK’s

housing stock. The latter was further emphasised in the

recent publication of The Housing White Paper, which

supports increasing the PRS sector.

A positive outlook

The prediction for the PRS market in 2017 and beyond is

very positive in terms of demand, funding and political

support. There is a genuine focus across the whole of the

UK to deliver more PRS product.

The Private

Rented Sector

is now often

seen as the

only realistic

option for

tenure

BPF figures

Regional growth is demonstrated by the BPF November

2016 figures, which show that there is now an even split

between London and the regions for PRS units.

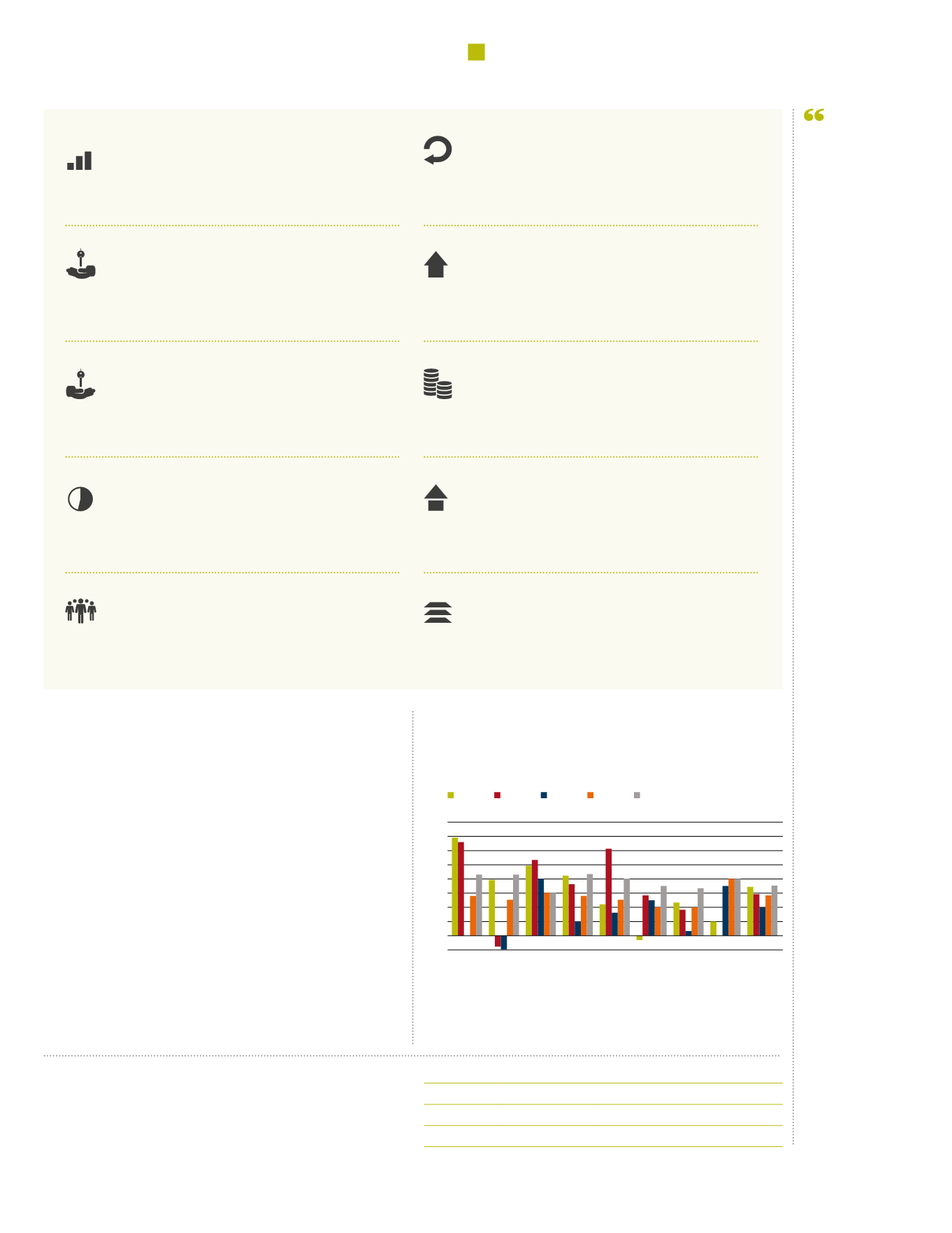

Rental growth levels by UK region

Rental growth across the UK for the next three years is

projected to be very positive. In general, this is fuelled by a

lack of good quality product and high customer demand.

Oct 2015

Oct 2016

% Increase

London

14,516

33,411

130%

Regions

7,112

34,415

384%

8

%

7

6

5

4

3

2

1

0

-1

Greater

London

2014

Central

London

East

South East

South West

Midlands

Wales

North

Scotland

2015

2016

2017*

2018*

Source: Countrywide Research Lettings Index. *Data based on forecasts

£30bn is ready to be invested

in PRS across the UK.

Latest IPD data shows a total return

from residential property of 13.5%.

58% of private renters are

aged between 25 and 44.

72% of PRS landlords own just one rental property.

Only 12% own more than three properties.

Just over half (51%) of private renters are

under 35, of which 54% have no dependents.

PRS is currently worth an estimated £1.29tn,

an increase of 55% since 2010.

By 2025, it is estimated that over 50% of 20 to

39 year olds in the UK will be in the PRS (PwC).

Demand for rental properties will grow by 1.1m

households by 2021 (20,000 units per month required).

The number of households in the PRS has more

than doubled since 2001 to 19% of the population.

Build to rent pipeline of over 40,000

units across the UK (BPF).

£30bn

58% aged 25-44

51% under 35

50%+ in PRS by 2025

19% of population

13.5%

72%

£1.29tn

+1.1m

40,000 units

£

CUSHMAN & WAKEFIELD21

SECTOR: PRS